Meals And Entertainment Expense For Employees . Office parties and outings held for the benefit of its employees (other. washington — the internal revenue service today urged business taxpayers to begin planning now to take. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. The internal revenue service (irs). fully deductible meals and entertainment. businesses can fully deduct the cost of: meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Here are some common examples of 100% deductible meals and entertainment expenses: for 2023, most business meals are just 50% deductible, according to the irs rule. Let’s say you take your favorite client to a.

from www.chegg.com

businesses can fully deduct the cost of: meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Here are some common examples of 100% deductible meals and entertainment expenses: washington — the internal revenue service today urged business taxpayers to begin planning now to take. Office parties and outings held for the benefit of its employees (other. fully deductible meals and entertainment. The internal revenue service (irs). for 2023, most business meals are just 50% deductible, according to the irs rule. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. Let’s say you take your favorite client to a.

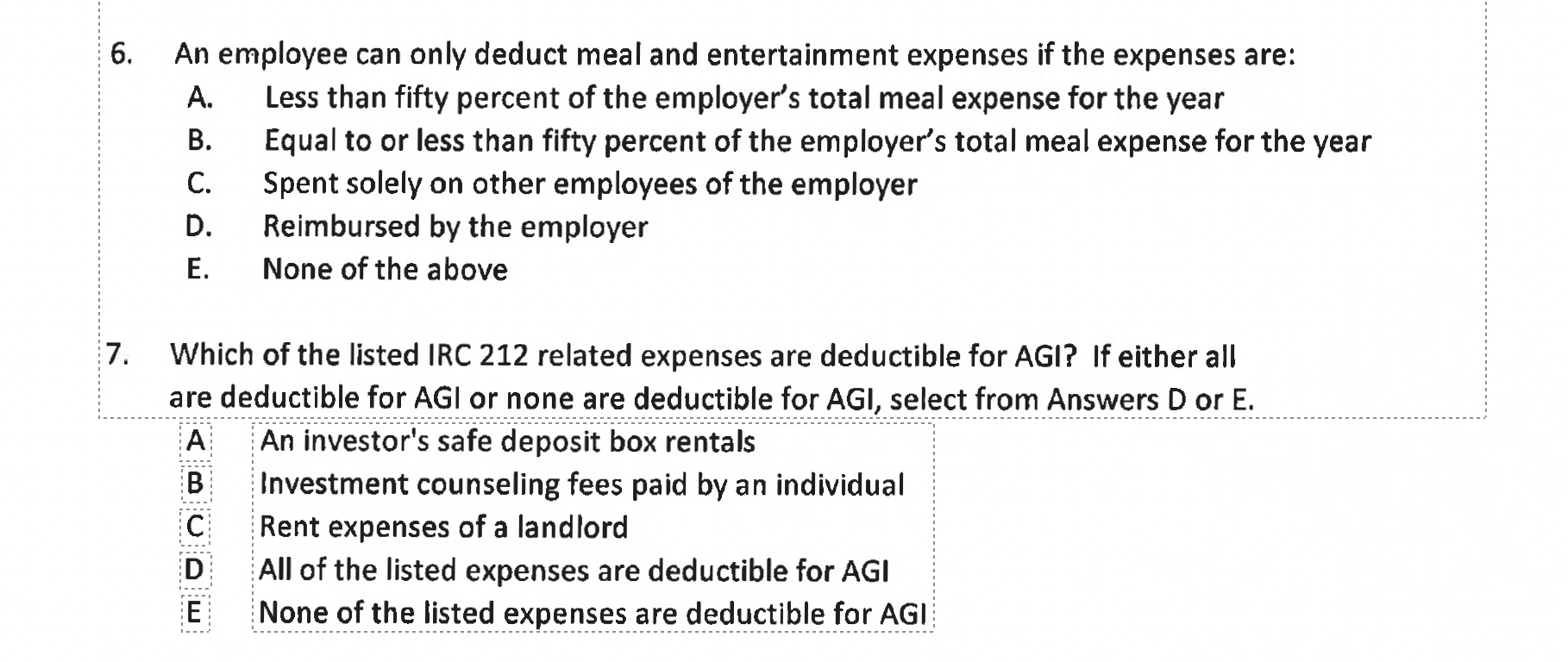

6. An employee can only deduct meal and entertainment

Meals And Entertainment Expense For Employees meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. The internal revenue service (irs). washington — the internal revenue service today urged business taxpayers to begin planning now to take. for 2023, most business meals are just 50% deductible, according to the irs rule. Office parties and outings held for the benefit of its employees (other. meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. fully deductible meals and entertainment. Let’s say you take your favorite client to a. businesses can fully deduct the cost of: business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. Here are some common examples of 100% deductible meals and entertainment expenses:

From www.coursehero.com

[Solved] · 1,500 in meal and entertainment expenses show as a... Course Hero Meals And Entertainment Expense For Employees for 2023, most business meals are just 50% deductible, according to the irs rule. businesses can fully deduct the cost of: Here are some common examples of 100% deductible meals and entertainment expenses: Let’s say you take your favorite client to a. washington — the internal revenue service today urged business taxpayers to begin planning now to. Meals And Entertainment Expense For Employees.

From www.scribd.com

Meals and Entertainment PDF Employee Benefits Expense Meals And Entertainment Expense For Employees Here are some common examples of 100% deductible meals and entertainment expenses: Office parties and outings held for the benefit of its employees (other. businesses can fully deduct the cost of: for 2023, most business meals are just 50% deductible, according to the irs rule. washington — the internal revenue service today urged business taxpayers to begin. Meals And Entertainment Expense For Employees.

From taxedright.com

Meals and Entertainment Deduction 2022 Taxed Right Meals And Entertainment Expense For Employees Let’s say you take your favorite client to a. businesses can fully deduct the cost of: Here are some common examples of 100% deductible meals and entertainment expenses: for 2023, most business meals are just 50% deductible, according to the irs rule. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. Office. Meals And Entertainment Expense For Employees.

From www.edgebusinessplanning.com

Tracking Employee Meals & Entertainment Expenses Meals And Entertainment Expense For Employees businesses can fully deduct the cost of: washington — the internal revenue service today urged business taxpayers to begin planning now to take. meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. fully deductible meals and entertainment. Office parties and outings held for the benefit of its employees (other.. Meals And Entertainment Expense For Employees.

From bbbooksinc.com

Meals, Travel and Entertainment Expenses, Oh My! Meals And Entertainment Expense For Employees meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Office parties and outings held for the benefit of its employees (other. businesses can fully deduct the cost of: washington — the internal revenue service today urged business taxpayers to begin planning now to take. fully deductible meals and entertainment.. Meals And Entertainment Expense For Employees.

From ryanreiffert.com

2022 Tax Changes Are Meals and Entertainment Deductible? Meals And Entertainment Expense For Employees The internal revenue service (irs). washington — the internal revenue service today urged business taxpayers to begin planning now to take. businesses can fully deduct the cost of: business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. Let’s say you take your favorite client to a. Office parties and outings held for. Meals And Entertainment Expense For Employees.

From www.cainwatters.com

Meals & Entertainment Deductions for 2021 & 2022 Meals And Entertainment Expense For Employees The internal revenue service (irs). washington — the internal revenue service today urged business taxpayers to begin planning now to take. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. for 2023, most business meals are just 50% deductible, according to the irs rule. Let’s say you take your favorite client to. Meals And Entertainment Expense For Employees.

From www.tukelinc.com

Travel, Lodging, Meals and Entertainment Expenses Tax and Compliance Meals And Entertainment Expense For Employees businesses can fully deduct the cost of: meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Office parties and outings held for the benefit of its employees (other. The internal revenue service (irs). Let’s say you take your favorite client to a. fully deductible meals and entertainment. Here are some. Meals And Entertainment Expense For Employees.

From bh-co.com

Meals & Entertainment Deductions What’s New for 2021 & 2022 Beaird Harris Meals And Entertainment Expense For Employees Here are some common examples of 100% deductible meals and entertainment expenses: fully deductible meals and entertainment. Let’s say you take your favorite client to a. Office parties and outings held for the benefit of its employees (other. businesses can fully deduct the cost of: The internal revenue service (irs). meals must be from restaurants, which includes. Meals And Entertainment Expense For Employees.

From www.stephanoslack.com

Meals and Entertainment Expenses in 2018 Stephano Slack Meals And Entertainment Expense For Employees for 2023, most business meals are just 50% deductible, according to the irs rule. washington — the internal revenue service today urged business taxpayers to begin planning now to take. businesses can fully deduct the cost of: Let’s say you take your favorite client to a. Office parties and outings held for the benefit of its employees. Meals And Entertainment Expense For Employees.

From www.pkfmueller.com

Update On Deducting Business Meal And Entertainment Expenses PKF Mueller Meals And Entertainment Expense For Employees Office parties and outings held for the benefit of its employees (other. washington — the internal revenue service today urged business taxpayers to begin planning now to take. The internal revenue service (irs). Let’s say you take your favorite client to a. meals must be from restaurants, which includes businesses that prepare and sell food or beverages to.. Meals And Entertainment Expense For Employees.

From cexalpru.blob.core.windows.net

Food And Entertainment Are Considered What Types Of Expenses at Elisa Smith blog Meals And Entertainment Expense For Employees The internal revenue service (irs). fully deductible meals and entertainment. Office parties and outings held for the benefit of its employees (other. washington — the internal revenue service today urged business taxpayers to begin planning now to take. meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. for 2023,. Meals And Entertainment Expense For Employees.

From www.pkfmueller.com

Tax Cuts and Jobs Act of 2017 Meals and entertainment expenses, and employee fringe benefits Meals And Entertainment Expense For Employees for 2023, most business meals are just 50% deductible, according to the irs rule. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. businesses can fully deduct the cost of: meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Let’s say you take your. Meals And Entertainment Expense For Employees.

From www.jotform.com

Why your business should plan for meal and entertainment expenses The Jotform Blog Meals And Entertainment Expense For Employees businesses can fully deduct the cost of: fully deductible meals and entertainment. meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. business meal expenses are generally 50% deductible, while entertainment expenses are no longer deductible. for 2023, most business meals are just 50% deductible, according to the irs. Meals And Entertainment Expense For Employees.

From cexalpru.blob.core.windows.net

Food And Entertainment Are Considered What Types Of Expenses at Elisa Smith blog Meals And Entertainment Expense For Employees washington — the internal revenue service today urged business taxpayers to begin planning now to take. Here are some common examples of 100% deductible meals and entertainment expenses: meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Office parties and outings held for the benefit of its employees (other. The internal. Meals And Entertainment Expense For Employees.

From www.chegg.com

6. An employee can only deduct meal and entertainment Meals And Entertainment Expense For Employees Let’s say you take your favorite client to a. washington — the internal revenue service today urged business taxpayers to begin planning now to take. businesses can fully deduct the cost of: for 2023, most business meals are just 50% deductible, according to the irs rule. Here are some common examples of 100% deductible meals and entertainment. Meals And Entertainment Expense For Employees.

From cexalpru.blob.core.windows.net

Food And Entertainment Are Considered What Types Of Expenses at Elisa Smith blog Meals And Entertainment Expense For Employees The internal revenue service (irs). washington — the internal revenue service today urged business taxpayers to begin planning now to take. Here are some common examples of 100% deductible meals and entertainment expenses: for 2023, most business meals are just 50% deductible, according to the irs rule. business meal expenses are generally 50% deductible, while entertainment expenses. Meals And Entertainment Expense For Employees.

From www.slideserve.com

PPT Chapter 6 PowerPoint Presentation, free download ID13821 Meals And Entertainment Expense For Employees meals must be from restaurants, which includes businesses that prepare and sell food or beverages to. Office parties and outings held for the benefit of its employees (other. for 2023, most business meals are just 50% deductible, according to the irs rule. businesses can fully deduct the cost of: The internal revenue service (irs). Here are some. Meals And Entertainment Expense For Employees.